Employment Insurance Reporting Form

Please enter the following information about your tip to report fraud. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125.

How To Fill Out Your Ei Internet Report Dutton Employment Law

The reporting calendar can help you keep track of your hours and earnings.

Employment insurance reporting form. POA Power of Attorney. On this report you need to enter the total earnings and hours worked for each week. Self-Insured Employers Permanent Partial Disability Closure Order and Notice - PPD-NTL F207-165-000 F207-165-999.

This form shall be. With My Service Canada Account you can view and update your Employment Insurance Canada Pension Plan. Sample Spreadsheet of Work-site Employers and Employees.

Streamline your employee intake process and seamlessly onboard new employees with JotForm. Form 1095-C is used by applicable large employers as defined in section 4980Hc2 to verify employer-sponsored health coverage and to administer the shared employer responsibility provisions of section 4980H. AdjApp Adjustment Application For quarters prior to CY2008 COM4069 Election for Reimbursement Option.

Employment Insurance Coverage Survey. The Forms Site provides access to online forms for the programs and services delivered by Service Canada and its partner departments. Paper Form Exception Filing Information In Ohio employers are required to submit their Quarterly Tax Return electronically.

Unemployment Insurance Fraud Reporting. DETR Unemployment Insurance Fraud Reporting Form. Employer Change Request UITL-2.

Self-Insured Employers Permanent Partial Disability Closure Order and Notice - PPD-TL F207-164-000 F207-164-999. The Access Code is the four-digit code that was sent to you by mail shortly after you applied for Employment Insurance benefits. Self-Insurance Vocational Reporting Form F207-190-000 Self-Insured Employers Medical Only Claim Closure Order and Notice F207-020-111 F207-020-999.

Types of benefits and related subjects. If you are liable for Unemployment Insurance you must electronically submit a Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45. Our easy-to-use Form Builder lets you customize form fields change.

This helps us to identify and correct hazards before they cause serious injuries. Box 45247 Salt Lake City UT 84145-0247. Report suspected unemployment benefit fraud and abuse individuals receiving UI and not reporting earnings EMPLOYER.

Your Access Code is your electronic signature and is required along with your Social Insurance Number SIN when you submit your reports. Previous Maximum Insurable Earnings Annual Reports. Monitoring and Assessment Reports.

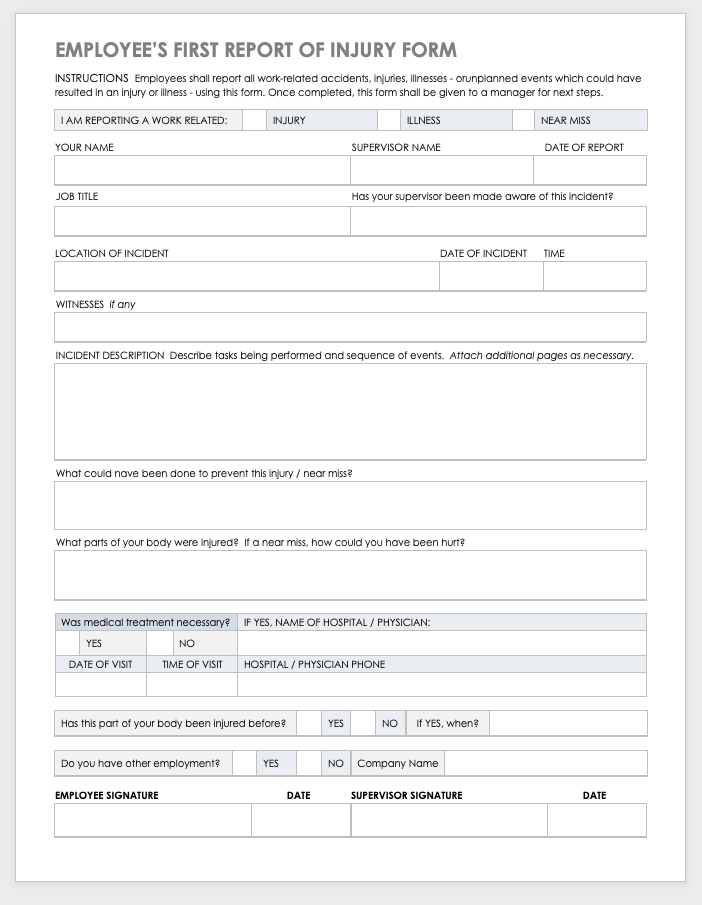

The Minnesota Unemployment Insurance Employer Self-Service System allows employers and agents to manage their account s using multiple filing methods. Includes information about Employment Insurance EI temporary benefits for workers sickness fishing and family-related benefits as well as how to apply online and submit a report. Employees Report of Injury Form Instructions.

Employment Insurance information for employers. We cannot provide information on the results of any investigation. Due to strict confidentiality laws the Nevada Department of Employment Training and Rehabilitation cannot confirm or deny an investigation initiated by the submission of this form nor can updates or outcomes be disclosed.

Information about Form 1095-C Employer-Provided Health Insurance Offer and Coverage including recent updates related forms and instructions on how to file. Employment Insurance reporting calendar. Report that you suspect an employee of receiving UI benefits after returning to work or has refused work.

Employment Insurance Tracking Survey. Summary of the Actuarial Report on the EI Premium Rate. UC-1 Report to Determine Liability.

DETR Unemployment Insurance Fraud Reporting Form. Please provide all known information regarding the person you suspect of committing fraud. Unemployment Insurance Contributions UTAH NEW HIRE REGISTRY REPORTING FORM.

Employees shall use this form to report all work related injuries illnesses or near miss events which could have caused an injury or illness no matter how minor. Application for Unemployment Insurance Account and Determination of Employer Liability UITL-100. Simply choose an Employee Information Form Template below to securely collect employee information like contact details medical history and emergency contact information.

Power Of Attorney UITL-18. Employers LIR27 Application for Certificate of Compliance with Section 3-122-112 HAR Use this form to request a tax clearance from the Department of Labor Industrial Relations for Professional Service Awards UC-1 Report to Determine Liability Under the Hawaii Employment Security Law In most cases if you have employees working in Hawaii you must pay unemployment. File the NYS-45 online by visiting the Department of Taxation and Finance website.

Utah New Hire Registry PO. Wage detail records must be submitted electronically using one of the. UC-8 Quarterly Tax Report For tax reporting for quarters beginning CY2018 through CY2021.

Fields marked with an asterisk are required. QPR1 Public EmployersMunicipalities. File uploads and downloads allow employers or their agents to manage large data files internally and submit them online.

Your information is appreciated. Employee Leasing Company Annual Report and Certification UITL-39. FAX to 801 -526 -4391 You may photo copy this original form for future use See.

QPR2 Reimbursable Employers. Submit this completed form within 20 days of a new employees first day of work to. Your identity will be kept confidential.

While youre receiving EI benefits you must submit a report every 2 weeks to show that youre eligible and to continue receiving benefits.

How To Fill Out Your Ei Internet Report Dutton Employment Law

Employment Insurance Ei Benefit Statement Canada Ca

How To Fill Out Your Ei Internet Report Dutton Employment Law

Free Workplace Accident Report Templates Smartsheet

Employment Insurance Ei Benefit Statement Canada Ca

Request For Payroll Information Forms Canada Ca

Financial Status Report Debt Management Center

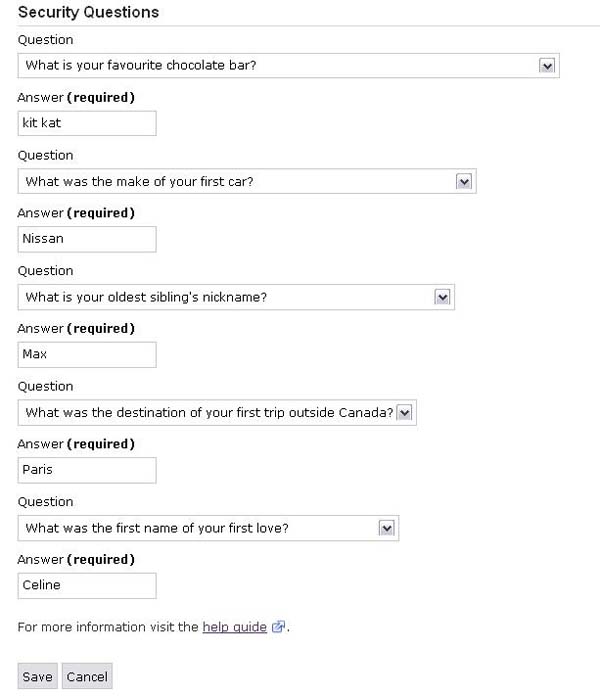

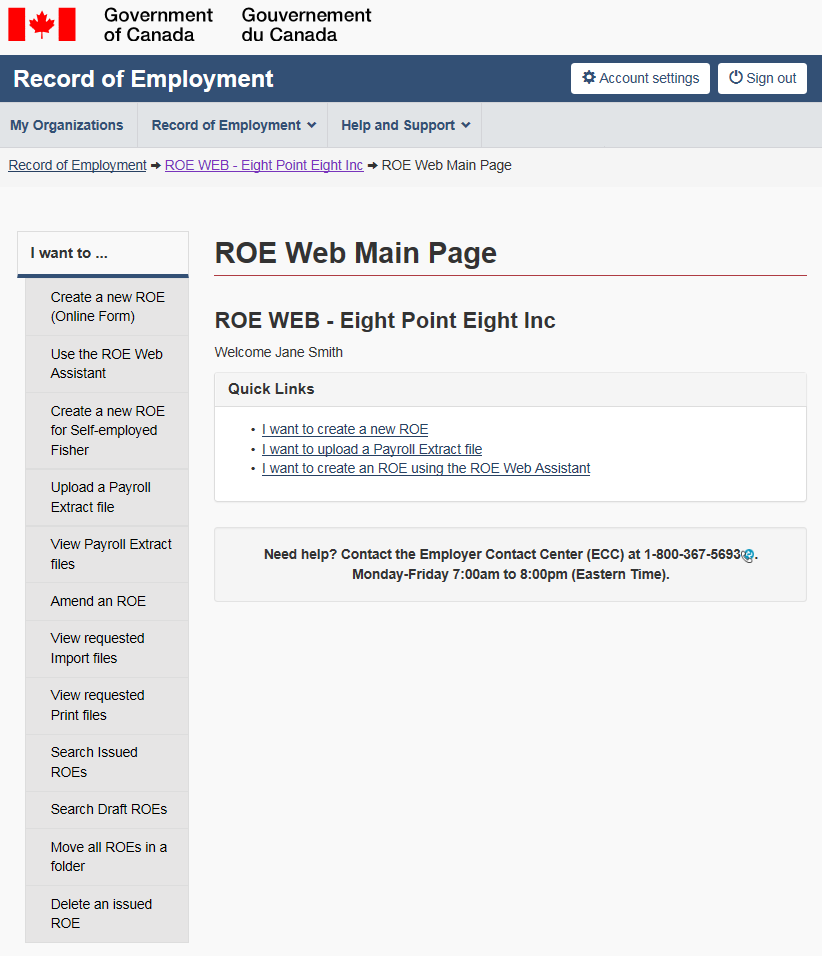

Roe Web Registration And Account Management Canada Ca

What Happens If Employer Fails To Issue Roe On Time Dutton Employment Law

Request For Payroll Information Forms Canada Ca

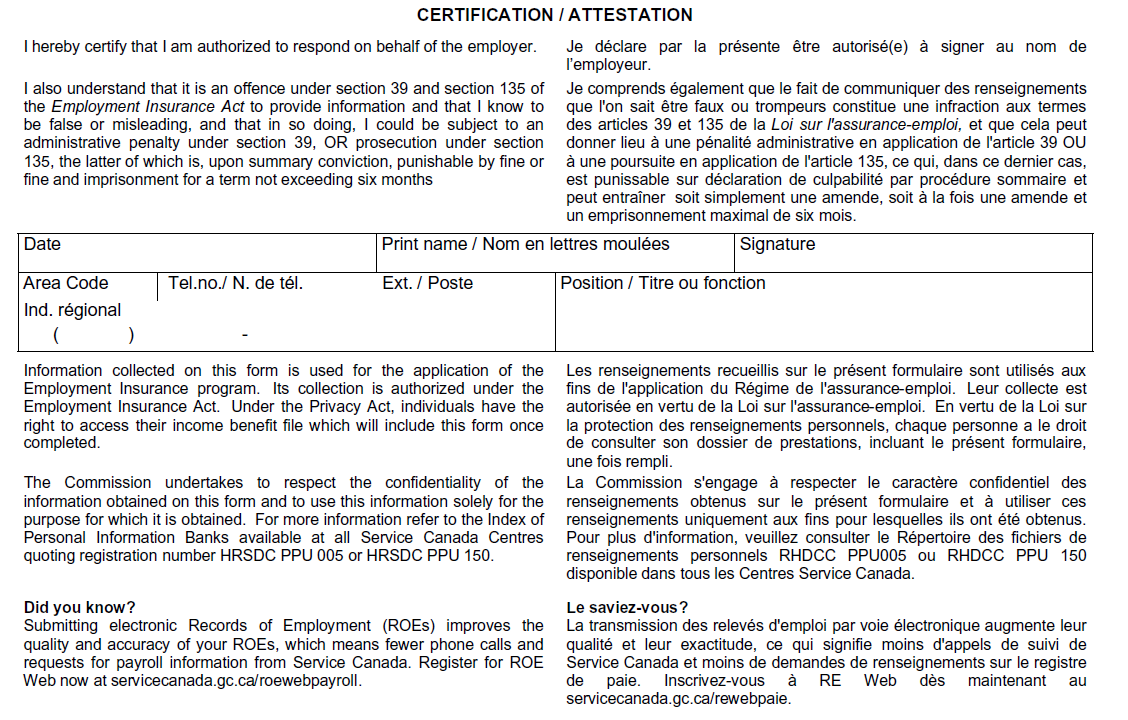

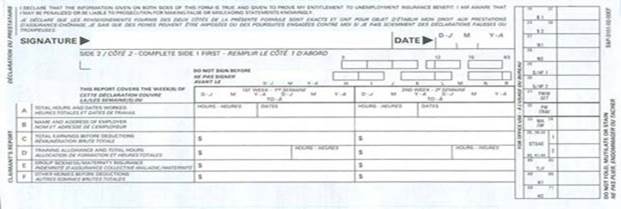

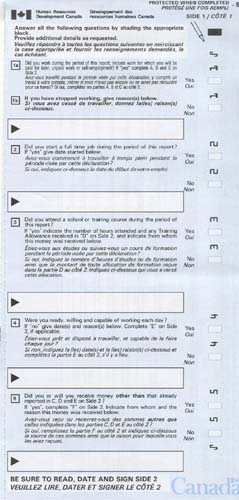

How To Complete Your Employment Insurance Paper Report Canada Ca

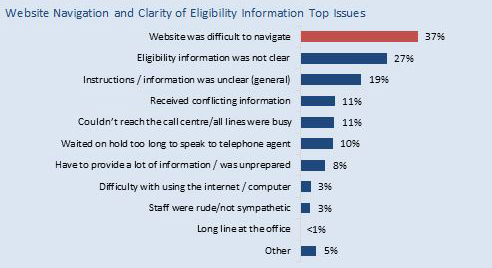

Employment Insurance Service Quality Review Report Making Citizens Central Canada Ca

Pin On 1000 Examples Online Form Templates

How To Complete Your Employment Insurance Paper Report Canada Ca

Free Employment Application Pdf Check More At Https Nationalgriefawarenessday Com 10831 Free Employment Application Pdf

Comments

Post a Comment