Employment Insurance Reporting Calendar

Unemployment Insurance Employment Services. Employment Insurance EI includes temporary benefits for workers sickness fishing and family-related benefits as well as how to apply online and submit a report.

How To Fill Out Your Ei Internet Report Dutton Employment Law

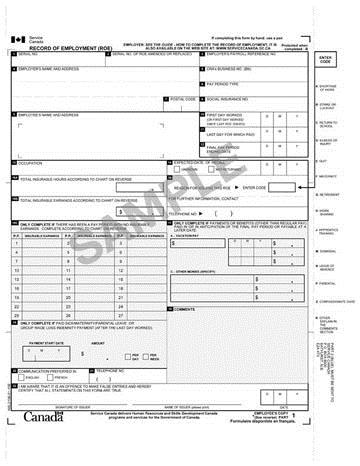

Each calendar quarter the law requires liable employers to report their payroll and pay unemployment insurance contributions.

Employment insurance reporting calendar. REPORTING CALENDAR While youre receiving Employment Insurance benets you must submit a report every 2 weeks to show that youre eligible and to continue receiving benets. The self-employed individual reports a net proit of less than. To obtain coverage the employer must ile a written election for coverage.

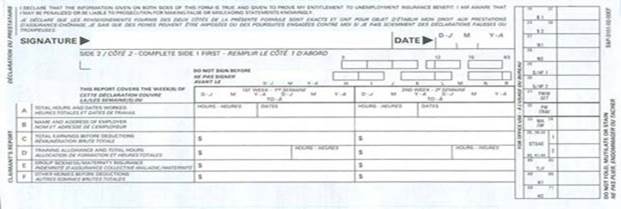

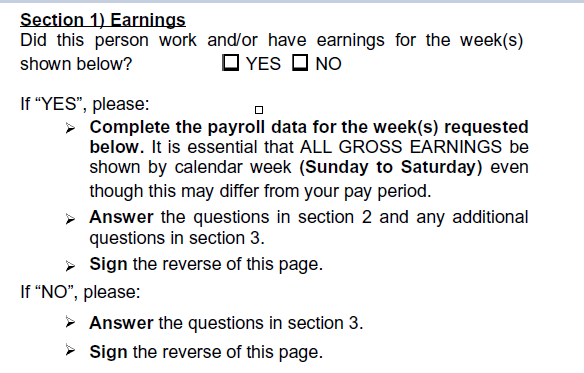

On this report you need to enter the total earnings and hours worked for each week. General mercLandise food stores 53 54. Finance insurance real estate.

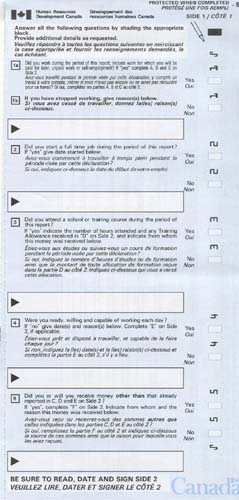

Store your access code in a safe place separately from your Social Insurance Number. While youre receiving EI benefits you must submit a report every 2 weeks to show that youre eligible and to continue receiving benefits. Failure to do so can mean a loss of benefits.

Of a day in 20 different calendar weeks will become liable employers. Unemployment Insurance UI. Reporting calendar to keep track of your earnings and hours worked Your Employment Insurance regular benefits application - Checklist Employment Insurance information for employers.

Claim Calendar 2018 UI Pub 173 Use this publication to follow your base year eligibility and claim year. Each week these reported New Hires are matched with individuals who have claimed weeks of benefits after the reported hire date and an audit form is mailed to the employer who reported. State Informati on Data Exchange System SIDES.

They do this on the Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45 which must be filed online see below for information about electronic filing. The reporting calendar can help you keep track of your hours and earnings. An audit form is mailed to all employers who have reported wages in the same calendar quarter in which benefits have been paid.

Reporting Unemployment Insurance Fraud. On this report you need to enter the total earnings and hours worked for each week. The other employees must be reported even if their employment was less than 20 different weeks or the wages paid were less than.

Employers meet the Section 6056 coverage reporting requirements with IRS Form 1095-C. The reportable cost for a year must take into account any changes in coverage for the employee during the year and it must be determined on a calendar year basis for all employees. This applies even if the wages are not subject to contributions.

Reporting for the 2011 calendar year meaning the Form W-2 generally required to be furnished to employees in January 2012 was optional. While your EI claim is active you must submit reports every two weeks to show you are still entitled to receive EI. Employers with an active employer account must submit a wage detail report even when no covered.

Self-insured employers usually meet the Section 6055 requirements along with the Section 6056 requirements by. A All with no more than 10 full- or part-time employees at any one time in the previous calendar year. For the 2012 calendar year and for future years employers generally are required to report the cost of health benefits provided on the Form W-2.

Employers from OSHA recordkeeping include. And B retail trade. New Hire Audit - All employers throughout the United States are required to report newly hired employees to a New Hire database.

Reports must be received on or before the last day of the month following the end of the calendar quarter. Insurance SDI coverage to an individual who is an employer. Minnesota Law 268044 Subd1 Each quarter employers that have employees in covered employment are required to submit a wage detail report electronically.

The reporting calendar can help you keep track of your hours and earnings. If services are performed during the calendar quarter all income or wages earned are required to be reported. Employees in some portion of a day in 20 separate weeks in the current calendar year or the preceding calendar year.

The most convenient way to submit your reports is through the Internet Reporting Service. Ie sics 52-89 except building materials garden supplies 52. View as Calendar View as List.

On the other hand if in our opinion a false or misleading declaration was made the length of time for revision is extended to 72 months. Change in Business Entity UI Pub 212 This informational flier covers the topic of status changes employers need to report and how to report them. Repair services 75 76.

Totals and a line to enter the due date of your next report. Hotels other lodging places 70. Employment Insurance reporting calendar.

Employers with a liability under this provision will also need to report any other employees except domestic workers. According to the EI Act we may review a claim for benefits within 36 months following the time the benefits were paid or became payable. DOMESTIC EMPLOYEES an employing unit paying wages of 1000 or more to domestic employees during any calendar quarter in the current calendar year or the preceding calendar year is a liable employer.

Telephone reporting service. This calendar should only be used as a calculation tool and cannot be presented as an actual report. Family and caregiving benefits Benefits to help your family with the costs of raising children maternity and parental leave compassionate care plus calculators to estimate benefit amounts to which you may be entitled.

For UI wages only if the.

How To Use A My Service Canada Account And Report Ei Online 2021 Personal Finance Freedom

How To Fill Out Your Ei Internet Report Dutton Employment Law

How To Complete Your Employment Insurance Paper Report Canada Ca

Chapter 4 Need More Information Canada Ca

Futa The Employer S Guide To Unemployment Taxes Bench Accounting

As An Ontario Disability Support Program Recipient When You Earn Money

Chapter 4 Need More Information Canada Ca

How To Use A My Service Canada Account And Report Ei Online 2021 Personal Finance Freedom

2021 Public Service Pay Calendar Canada Ca

2021 Public Service Pay Calendar Canada Ca

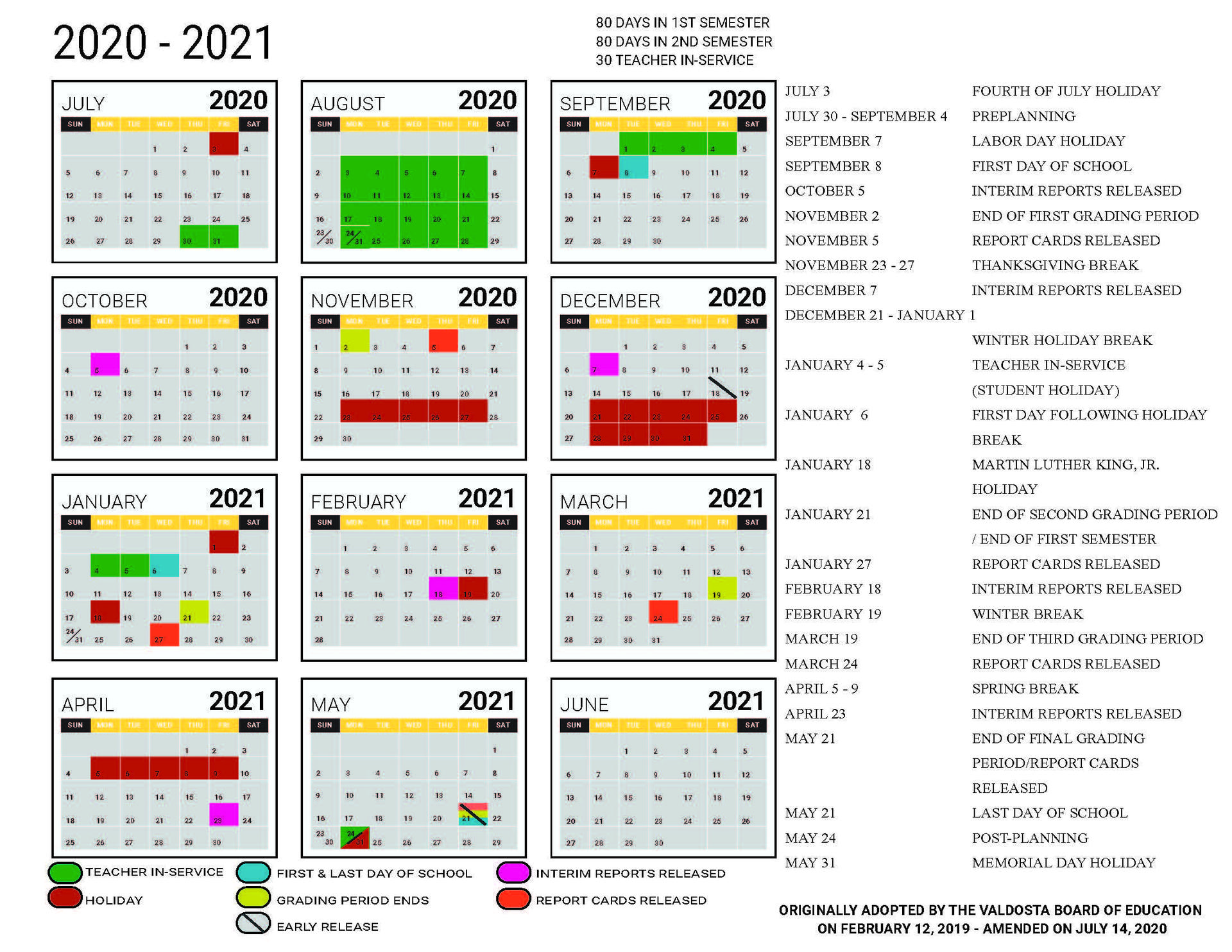

2020 2021 Academic Calendar Student Support Services Valdosta City School District

How To Complete Your Employment Insurance Paper Report Canada Ca

Chapter 4 Need More Information Canada Ca

How To Use A My Service Canada Account And Report Ei Online 2021 Personal Finance Freedom

Chapter 4 Need More Information Canada Ca

Https Www Edd Ca Gov Pdf Pub Ctr De3f Pdf

How To Use A My Service Canada Account And Report Ei Online 2021 Personal Finance Freedom

How To Use A My Service Canada Account And Report Ei Online 2021 Personal Finance Freedom

Comments

Post a Comment